Green Finance Unlocked. A Primer for Sustainable Real Estate

Report by ULI (2025) | Underwriting, Financing, Capital Stack

Curators: Asha Lad and Bill Bateman

London, UK

This post is accessible to all readers.

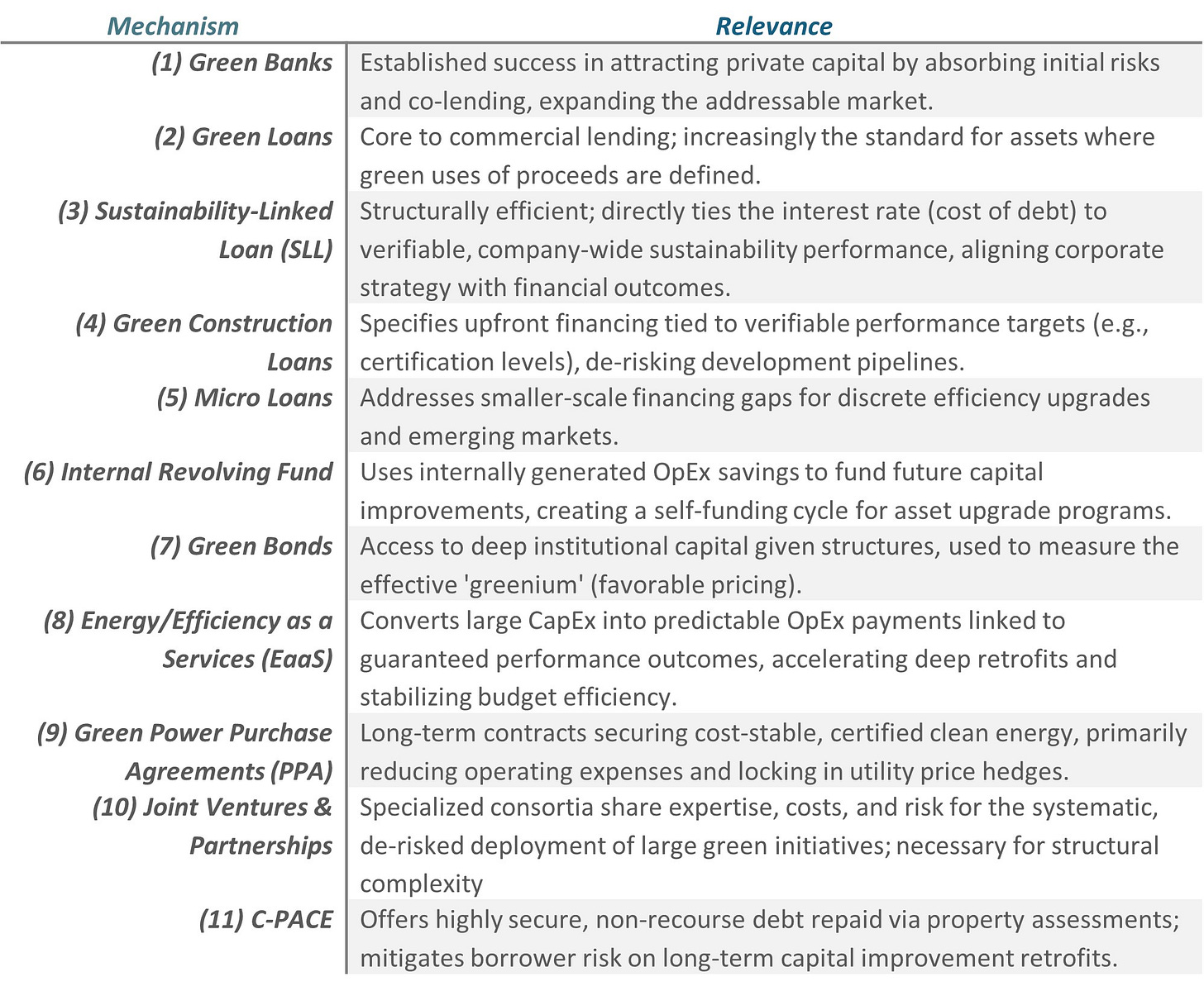

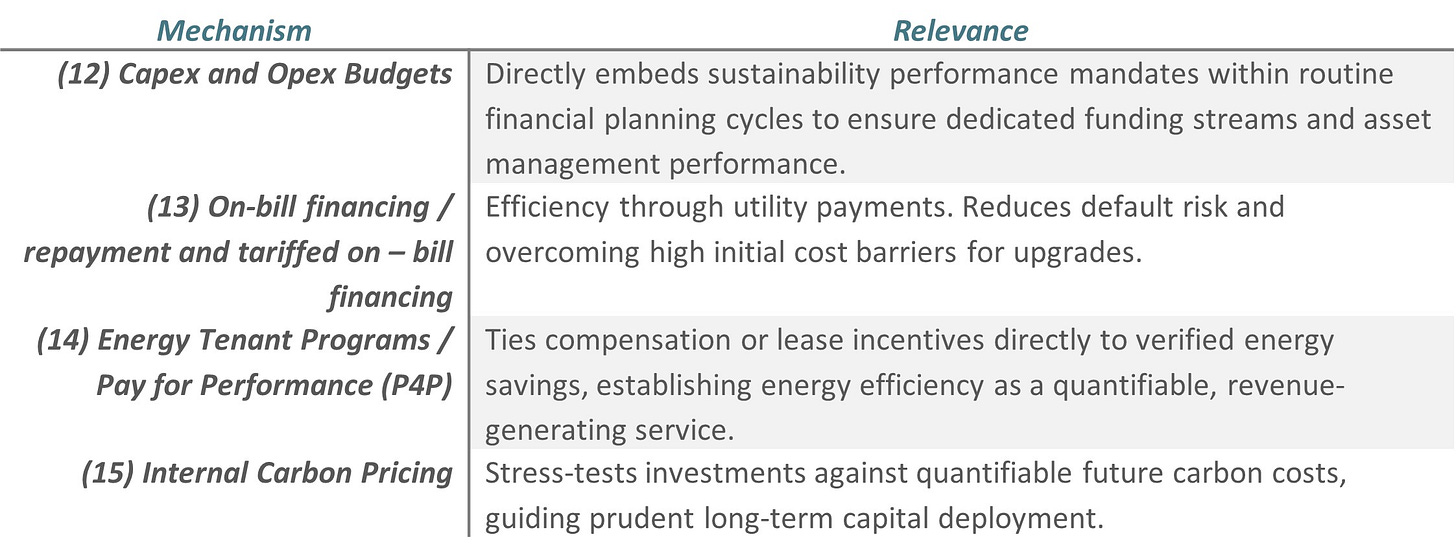

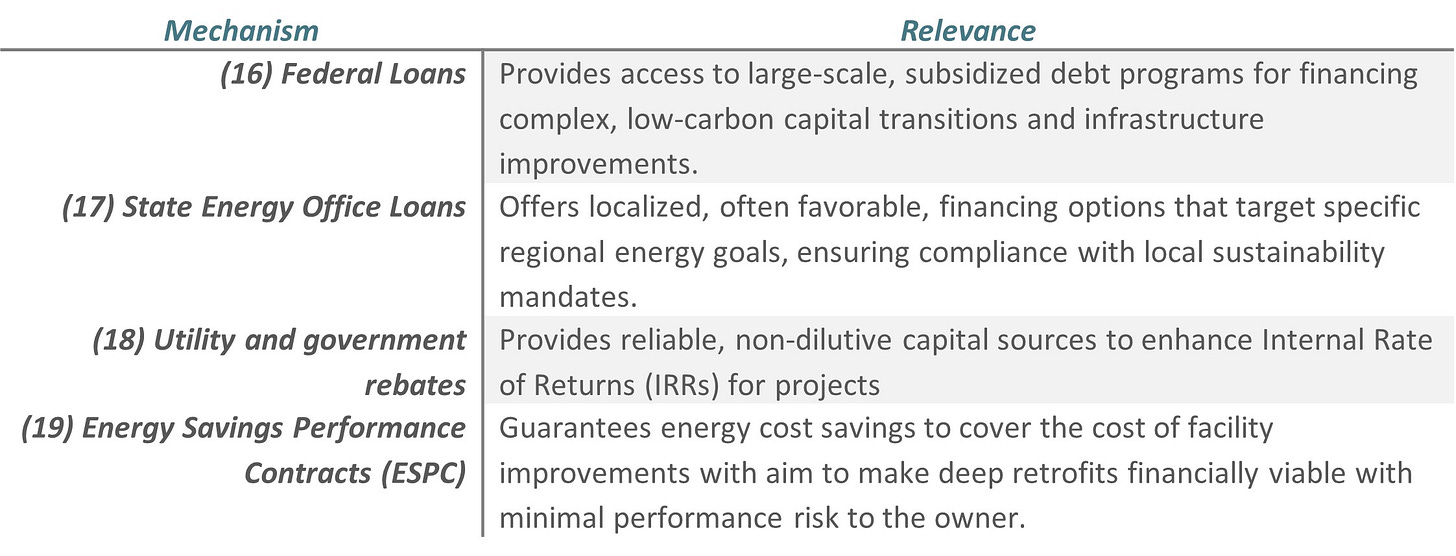

Why we recommend it: This primer offers a timely and actionable synthesis of the current green finance landscape. It moves beyond broad sustainability mandates to deliver an overview of mechanisms that can directly influence capital formation, risk management, and asset valuation. This primer demonstrates acceleration and maturation of the green finance market. The 19 established product offerings showcase the numerous ways considered to achieve integration of sustainability performance across the entire asset lifecycle, while addressing concerns from upfront capital barriers to long-term physical and transition risks. We have re-grouped these into 3 categories: private direct, private indirect and government market solutions.

Key takeaways:

- The report provides a structured, granular view of the maturing green finance ecosystem. It covers solutions applicable in the US across diverse asset classes, investment sizes, and risk profiles:

A. Private Direct Market Solutions (across cost of capital spectrum)

B. Private Indirect Solutions

C. Government Market Solutions

To access the document click 🔗 this link

If you encounter any difficulties, please contact us at info@samcurated.com and we will provide you with assistance. Please allow 24 to 48 hours for turnaround times, slightly longer during the weekends.

Disclaimer: SAM Curated, the curators and any other guests invited to share their opinions assume no responsibility or liability for any errors or omissions in the content of this site and/or email generated by this site. Please note that the information on this site is provided on an “as is” basis, with no guarantees of completeness, accuracy, usefulness or timeliness.